This quick reference guide is designed to provide guidance on answering the declarations prior to submitting foreign investment proposals and variation applications in the FIRB Application Portal (Portal).

NB: Before submitting a foreign investment proposal or variation application, the declarations must be completed.

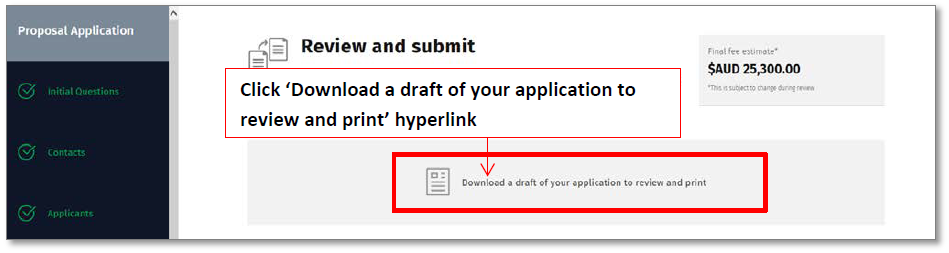

How to review the application

- On the 'Review and submit' screen, click on the 'Download a draft of your application to review and print' hyperlink in the middle of the page.

- The draft application will open in a new pop-up window. Review the draft application.

NB: If errors are identified, close the preview by clicking on the 'Close' icon in the top right of the pop-up window. Navigate to the page containing the identified errors using either the links in the application menu on the left of the screen, or by clicking on the black 'Previous' button at the bottom left of the screen.

- Close the preview by clicking on the close icon in the top right corner of the pop-up window.

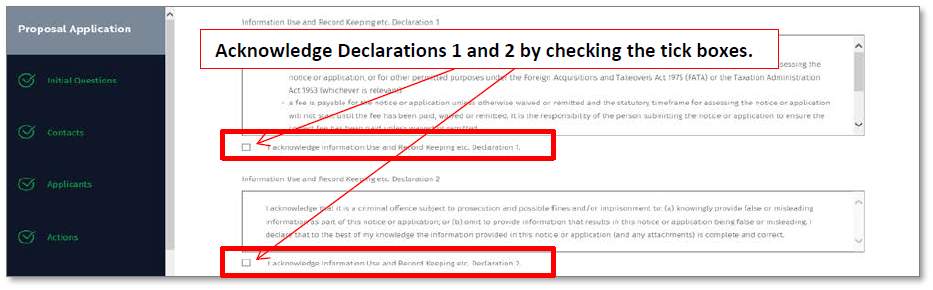

How to acknowledge the declarations

NB: The authorised consent declaration and the information use and record keeping declarations are mandatory for both a proposal or variation application.

- On the 'Review and submit' screen, read through the 'Authorised Consent Declaration'.

- Acknowledge the information in the 'Authorised Consent Declaration' by either checking the tick box next to 'I acknowledge Authorised Consent Declaration' or 'Not applicable (I am not using an agent and am submitting my own application').

- Read through the 'Information Use and Record Keeping etc. Declaration 1'.

- Acknowledge the information in Declaration 1 by checking the tick box next to the statement 'I acknowledge Information Use and Record Keeping etc. Declaration 1'.

- Read through 'Information Use and Record Keeping etc. Declaration 2'.

- Acknowledge the information in Declaration 2 by checking the tick box next to the statement 'I acknowledge Information Use and Record Keeping etc. Declaration 2'.

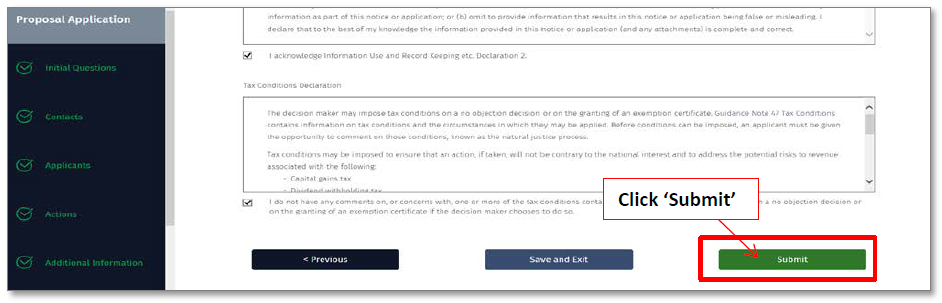

If submitting a proposal application

- Read through the final 'Tax Conditions Declaration'.

NB: Refer to Guidance Note 12 – Tax Conditions for additional information, where needed.

- Acknowledge the information in the 'Tax Conditions Declaration' by checking the tick box next to the statement.

NB: This declaration is not mandatory. If this declaration is not acknowledged and the decision maker proposes to impose development conditions, additional comments will be requested during the application process.

'Interest in land - Commercial land - Vacant' applications

- Read through the 'Commercial Land (Vacant) Conditions' declaration.

NB: Refer to Guidance Note 4 – Commercial Land for additional information, where needed.

- Acknowledge the information in the 'Interest in Land – Commercial Land – Vacant' declaration by checking the tick box next to the statement.

NB: This declaration is not mandatory. If this declaration is not acknowledged and the decision maker proposes to impose tax conditions, additional comments will be requested during the application process.

If submitting a variation application

- Read through the 'Existing Approval Conditions Declaration'.

- Acknowledge the information in the declaration by checking the tick box next to the corresponding statement. For example, if the declaration is correct, check the tick box next to the statement 'Yes'.

NB: This declaration is mandatory for a variation application.

How to submit the application

- To submit the application, click on the green 'Submit' button on the bottom right of the screen.

NB: Treasury will send a confirmation email containing a copy of the submitted application and a submission receipt number. If the confirmation email is not received within an hour, and it is not in a junk folder, contact Treasury during business hours (9:00 am-12:30 pm and 1:30 pm-5:00 pm, Monday to Friday, AEST) on 02 6263 3795 (or if calling from overseas +61 2 6263 3795).